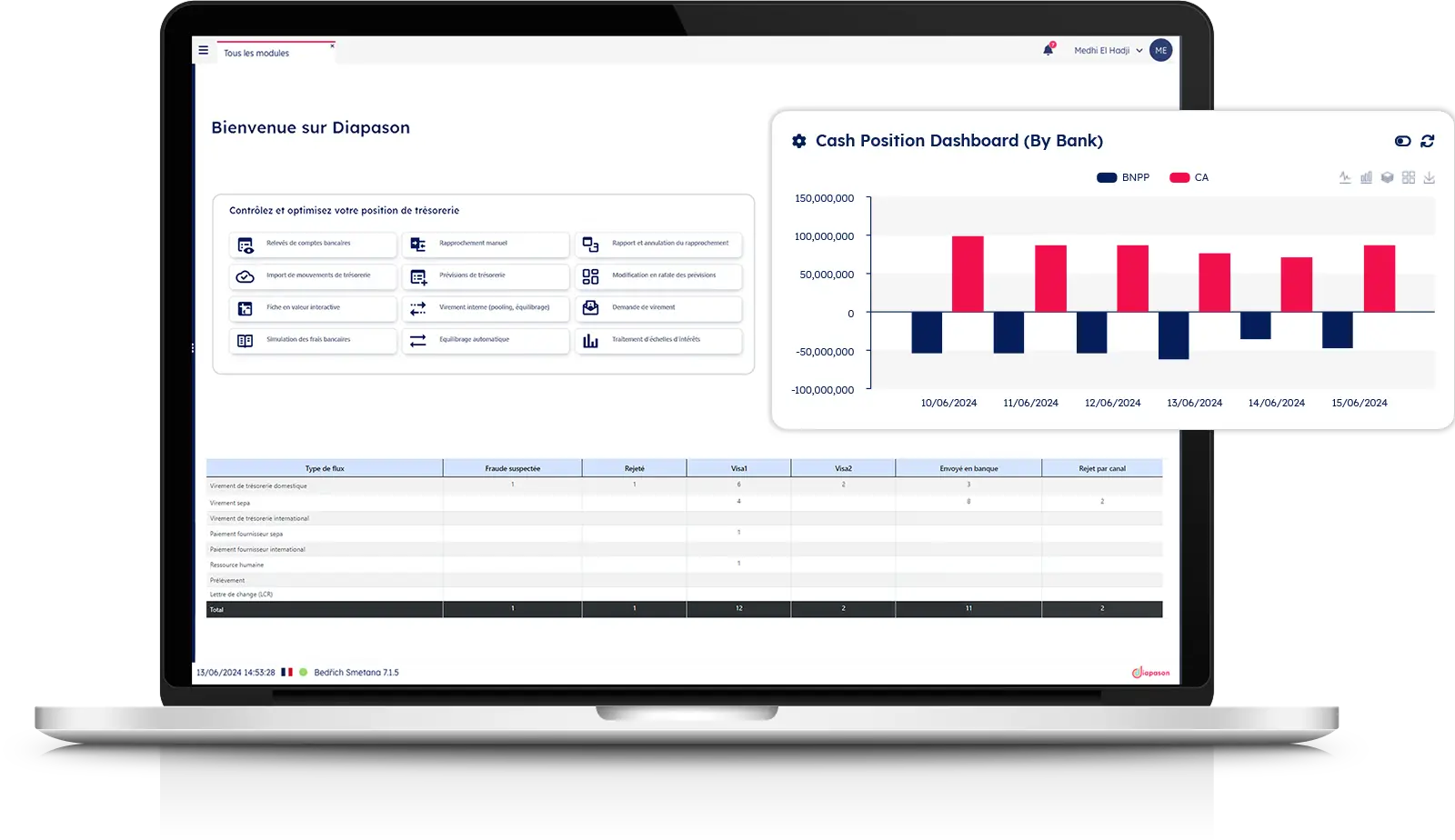

Optimize All Your Financial Resources, Beyond Just Cash

myDiapason Liquidity goes beyond simple Cash Management to offer you a comprehensive and strategic approach to optimizing financial resources. Our solution enables you to manage your treasury in real-time, anticipate future needs, and make informed decisions to maximize value creation.

Complex Information Consolidation

Challenges in collecting and centralizing treasury data, especially in a multi-subsidiary or international context.Clear Consolidated View

- Automated Multi-Bank

- Centralization

- Real-Time Dashboards

- Multi-Dimensional Analytics

- Automated Reconciliations

Impact: Informed Decisions, Seized Optimization Opportunities

Unreliable and time-consuming forecasts

Difficulties anticipating needs in a volatile environment, leading to reactive managementUnreliable & Time-Consuming Forecasts

- Difficulty anticipating needs in a volatile environment, leading to reactive management

- High-impact, accurate forecasting

- Advanced predictive models

- Automated multi-scenario simulations

- Integrated artificial intelligence

- Configurable proactive alerts

Impact: Optimized financing and investments

Manual & Redundant Processes

Heavy reliance on spreadsheets and time-consuming manual tasks that limit strategic analysisAutomated Processes & Time Savings

- Automation of repetitive tasks

- Customizable workflows

- ERP integration

- Focus on strategic analysis

Impact: Increased productivity, reduced errors

Complex Bank Communication

Multiple interfaces and exchange formats complicate the centralization of information flowsSimplified Bank Communication

- Standardized multi-bank connectivity

- Support for universal formats

- Enhanced security

- Full traceability

Impact: Lower maintenance costs, faster processing

Why Act Now?

They Optimized Their Liquidity with myDiapason

“We took advantage of this change management process to overhaul our workflows — communication reference frameworks, transaction codes, and analytical structures — to better align with our strategic developments, moving us forward towards greater modernity.”

Sylvain Lhomme , Financing and Treasury Director, Maisons du Monde

Fast Implementation and Expert Support

myDiapason Liquidity s’intègre parfaitement à votre écosystème existant :

Intégration

with leading ERPs

Open APIs

for customized integrations

Flexible deployment

multi-tenant or single-tenant based on your needs

Rapid implementation

typically within 8 to 12 weeks

Our team of experts, made up of former corporate treasurers, supports you at every step for a smooth and controlled transition.