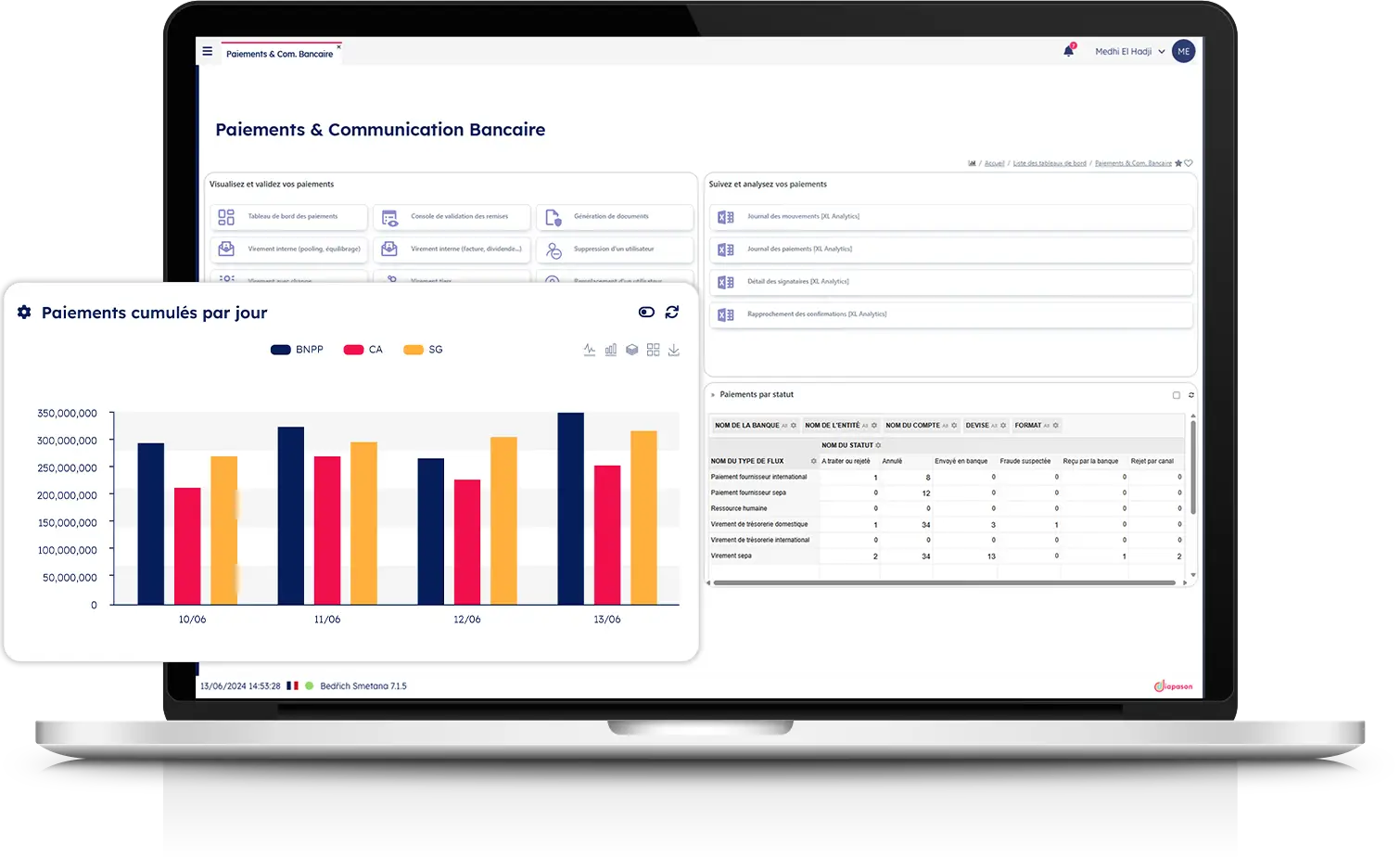

Secure and Centralize All Your Payments Across Europe and Worldwide

myDiapason Payment is a comprehensive payment management solution that allows you to centralize, control, and secure all your payments—regardless of their origin or destination. Benefit from customizable approval workflows, advanced fraud prevention controls, and complete visibility over all your outgoing financial flows.

Increasing Fraud Risks

Rising sophistication of both external and internal fraud attempts, exposing the weaknesses of traditional systems.Reduced Fraud Risk

- Multi-layered fraud prevention controls

- Enhanced authentication mechanisms

- Automated anomaly detection

- Full traceability of all transactions

Impact: Maximum protection, significant reduction in financial losses

Complex Validation Processes

Manual, fragmented, and rigid approval chains lead to delays and lack of visibility.Streamlined Validation Processes

- Configurable automated workflows

- Seamless digital approvals

- Real-time traceability

- Smart delegation management

Impact: Faster processing times, improved supplier relationships

Fragmented Payment Channels

The coexistence of legacy systems and multiple e-banking platforms creates complexity in reconciliation and global monitoring.Centralized Payment Channels

- Unified multi-channel platform

- Native integration with e-banking systems

- Automated reconciliation

- 360° visibility over payment flows

Impact: Lower operational costs, elimination of errors

Increasing Compliance Pressure

Constantly evolving regulations (PSD2, SWIFT, SEPA, etc.) require frequent and costly system updates.Enhanced Compliance Management

- Automatic regulatory updates

- Full PSD2/SEPA compliance

- Automated reporting

- Built-in audit documentation

Impact: Guaranteed compliance, elimination of penalty risks

Why Securing Your Payments Has Become Critical

They Secure Their Payments with myDiapason

“The implementation of payments in Diapason was successfully completed in a very short timeframe and fits into Lyreco’s plan to renew and centralize treasury management tools and oversee its currency hedging policy.”

Estelle Bonnemaison, Group Treasurer, Lyreco

Seamless Integration into Your Ecosystem

myDiapason Payment fits perfectly within your existing environment:

Integration

with leading ERPs

Compatibility

with major banking formats and protocols

Flexible Deployment

SaaS multi-tenant or single-tenant options tailored to your needs

Connectors

with anti-fraud solutions

Our team of financial security experts supports you throughout the entire project, from needs analysis to user training.