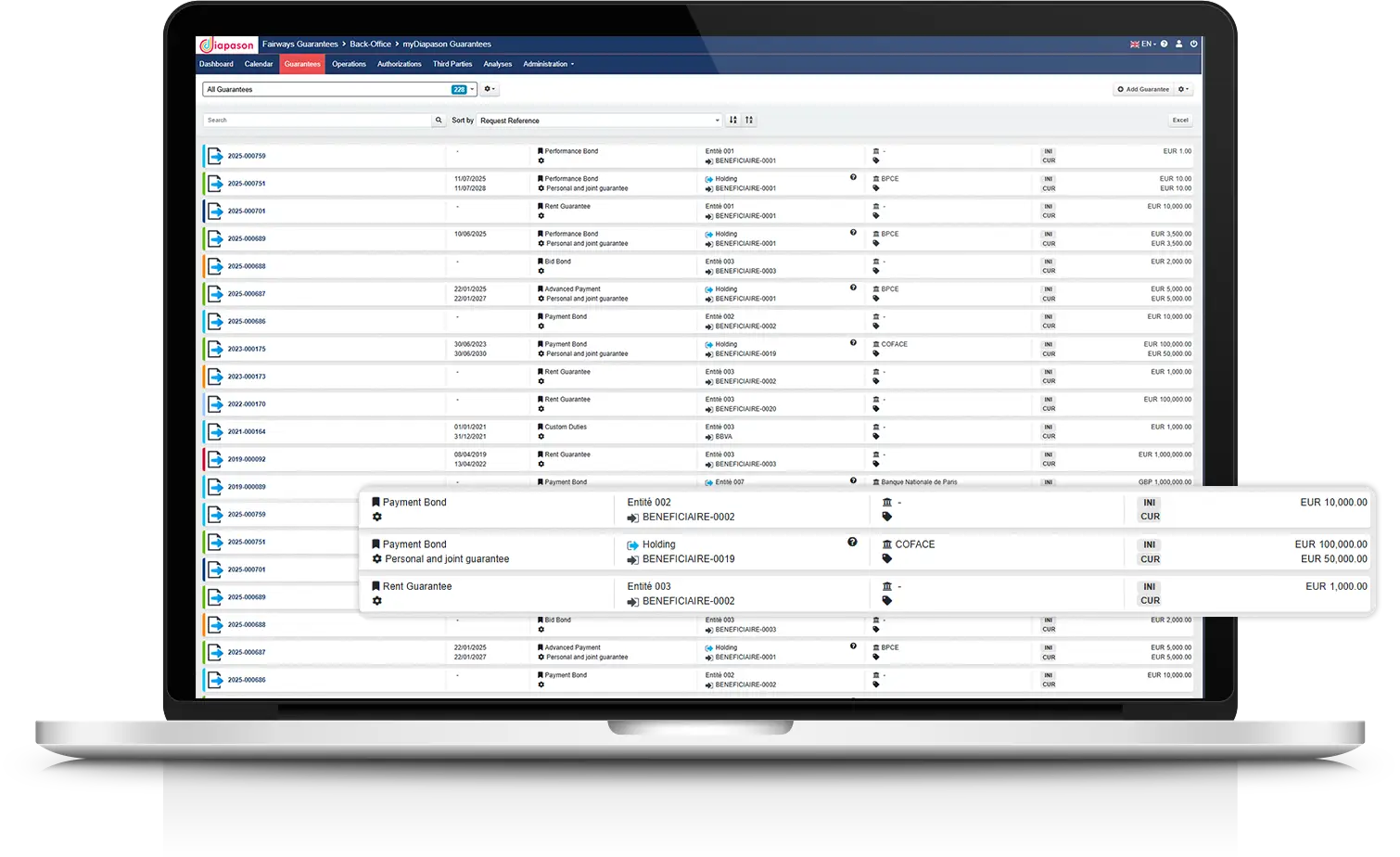

Manage Your Bonds and Guarantees Strategically

myDiapason Guarantees is the dedicated solution that enables you to centralize and optimize the management of all your bonds, bank guarantees, and other off-balance sheet commitments. Gain visibility, reduce costs, and secure your processes with an intuitive solution specially designed to meet the specific needs of this often-overlooked class of financial assets.

Current Challenges in Managing Bonds and Guarantees

In today’s financial environment, treasurers and CFOs face major challenges managing off-balance sheet commitments that generate hidden costs and limit financial flexibility. Discover how myDiapason Guarantees turns these challenges into opportunities.

Lack of Visibility and Centralization

Management is scattered across subsidiaries and systems with no consolidated view of total commitments.Visibility and Centralization of Your Guarantees

- Centralized database

- Real-time consolidated view

- Multi-entity analysis

- Advanced multi-criteria search

Impact: Optimized credit lines, elimination of duplicates

Manual and Time-Consuming Processes

Complex administrative tracking of issuances, amendments, and releases consumes excessive time.Automation and Time Savings

- Automated validation workflows

- Scheduled deadline alerts

- Integrated document management

Full lifecycle tracking

Impact: Reallocation to higher-value tasks

Unreleased or Forgotten Guarantees

Lack of systematic tracking leads to guarantees remaining active after obligations end.Optimized Guarantee Releases

- Automatic release identification

- Contract condition monitoring

- Personalized proactive alerts

Optimized re-invoicing

Impact: Credit line release, banking fee savings

Complex and Time-Consuming Reporting

Difficulty producing accurate consolidated reports exposes risks of non-compliance.Comprehensive and Consolidated Reporting

- Customizable predefined reports

- Automated accounting exports

- Native IFRS compliance

Facilitated ad hoc analysis

Impact: Optimal resource allocation, guaranteed compliance

Why Optimizing Your Guarantee Management Has Become Essential

Seamless Integration into Your Financial Ecosystem

myDiapason Guarantees is fully integrated into the myDiapason suite and connects effortlessly to your information system through a comprehensive library of APIs.

Integration

with the myDiapason platform

Vialink connector

for embedded issuance requests

Open API

for tailored integrations

Thanks to our partnership with Vialink, now Signaturit Group, an integrated connector enables issuance requests to be made directly within myDiapason Guarantees and transmitted seamlessly to the issuance portal.

A team of guarantees experts supports you throughout the implementation and optimization of your processes, from initial analysis to user training.