Integrate Risk Management into Your Treasury to Anticipate and Optimize Financial Decisions

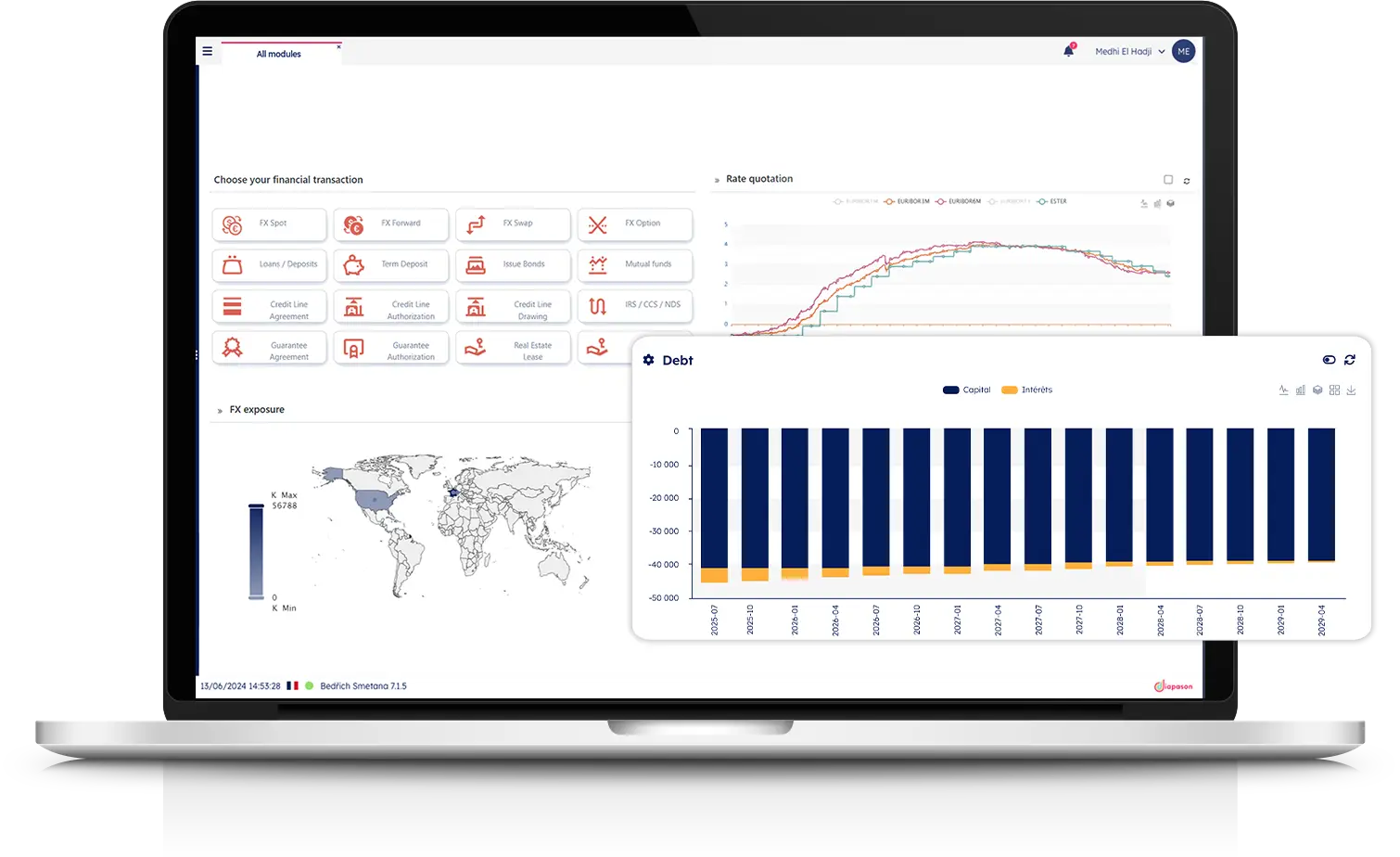

myDiapason Risk enables you to identify, measure, and manage all your financial risks—underlying positions and hedging derivatives (FX, interest rates, debt, commodities, liquidity, and counterparties)—within a single platform integrated with your treasury management system. Transform your risk approach from simple protection into a genuine performance driver.

Increased Market Volatility

Significant and sudden fluctuations in rates, currencies, and commodities create major uncertainty.Anticipated Market Volatility

- Stress tests and multiple scenarios

- Advanced sensitivity analyses

- Configurable proactive alerts

- Adaptive hedging strategies

Impact: Protects margins and ensures budget predictability

Isolated Risk Management

Siloed approaches without consolidated exposure views lead to suboptimal decisions.Comprehensive Risk Management

- Complete exposure mapping

- Native multi-entity consolidation

- Real-time cross-functional visibility

- Identified risk correlations

Impact: Optimizes hedging costs and operational efficiency

Limited Analytical Tools

Basic systems that don’t allow advanced analysis or precise scenario evaluation.Comprehensive Analytical Tools

- Alternative strategy simulations

- Real-time mark-to-market valuation

- Sophisticated risk modeling

- Dynamic dashboards

Impact: Optimal strategies and maximum responsiveness

Complex Regulatory Compliance

Increasing requirements (EMIR, IFRS 9, etc.) create a heavy administrative burden for risk management.Enhanced Compliance Response

- Simplified regulatory compliance

- Automated IFRS 9 compliance

- Native EMIR reporting

- Integrated audit documentation

- Complete audit trail

Impact: Reduces compliance costs and eliminates sanctions

Why Has Integrated Risk Management Become Essential?

Seamless Integration into Your Financial Ecosystem

myDiapason Risk naturally integrates with other modules in the myDiapason suite and your existing environment:

Native Integration

with the myDiapason suite

Integration

with major ERPs and accounting systems

Interfaces

with Trading and Financial Information Platforms

Flexible Deployment

tailored to your requirements

Our team of financial risk management experts supports you in defining and implementing your risk policy.