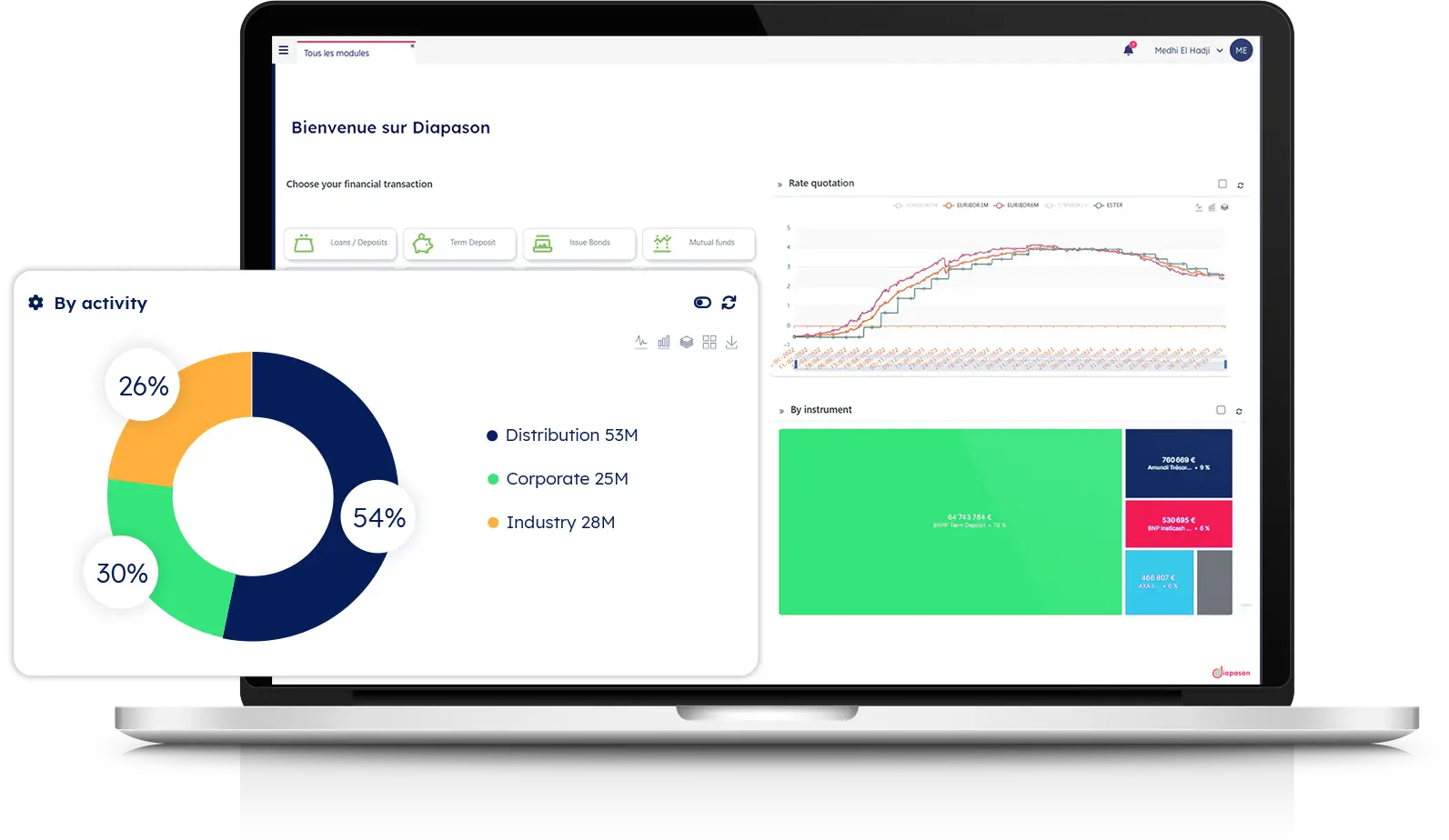

Optimize the Management of Your Investments and Equity Holdings

myDiapason Invest is a solution that allows you to manage all your investments and equity securities within a single, integrated platform. From day-to-day transaction management to detailed reporting and performance analysis, our solution provides all the tools needed to optimize investment decisions and simplify processes.

Fragmented Information and Tools

Multiple platforms and spreadsheets create a fragmented portfolio view and complicate consolidation.Centralized Information and Tools

- Single multi-asset platform

- Automated consolidation

- 360° portfolio overview

- Unified dashboards

Impact: Optimal decisions and seizing opportunities

Complex Tracking of Corporate Actions

Time-consuming manual handling of corporate actions exposing you to costly errors and omissions.Accurate Corporate Actions Management

- Automated processing of corporate actions

- Configurable approval workflows

- Settlement and delivery reconciliation

- Complete audit trail

Impact: Eliminated losses and reliable accounting

Cumbersome and Unreliable Reporting

Manual production of consolidated reports causing delays and inconsistent data.Simplified and Reliable Reporting

- Automated regulatory reports

- Compliance with accounting standards

- Native journal entry generation

- Real-time reporting

Impact: Maximum responsiveness and optimized allocation

Insufficient Performance Analysis

Limited analytical tools preventing identification of portfolio strengths and weaknesses.Impactful Performance Analysis

- Market-standard performance calculations

- Multi-dimensional attribution

- Automatic benchmark comparison

- Optimal allocation simulations

Impact: Optimized returns and controlled risk exposure

Why Has Integrated Risk Management Become Essential?

Seamless Integration into Your Financial Ecosystem

myDiapason Invest integrates naturally with other modules in the myDiapason suite and your existing environment:

Native synchronization

with myDiapason Liquidity to align cash and investment management

Integration

with leading ERPs and accounting systems

Standardized interfaces

with major custodians and market platforms

of market data (prices, rates, indices, etc.)

des données de marché (prix, taux, indices…)

Our team of asset management experts supports you every step of the way — from initial analysis to advanced training — to help implement and optimize your processes.